Last Friday, Attorney General and Gubernatorial candidate Doug Gansler announced his support for raising the minimum wage in Maryland to $10 by 2015. This would equate to an annual salary of approximately $21,000. (I try to include the annual salary equivalent in these discussions because I assume that all of us think of the minimum wage as our 16-year-old selves, while we think of salaries from an adult perspective.) Maryland's minimum wage is $7.25 ($15,080), the federal benchmark.

This is an issue I think about a lot. I think it is clear that the minimum wage needs to be re-examined, but I am concerned about the burden placed on small businesses whose personnel costs are already significant. In weighing these concerns, let's get rid of two persistent myths.

1. Minimum Wage requirements destroy jobs. This explanation is normally thrown out instinctively whenever the minimum wage is discussed. "You think a low wage is bad? How about no wage?"

This chart shows that many of the states that raised the minimum wage in times of low employment actually saw job growth:

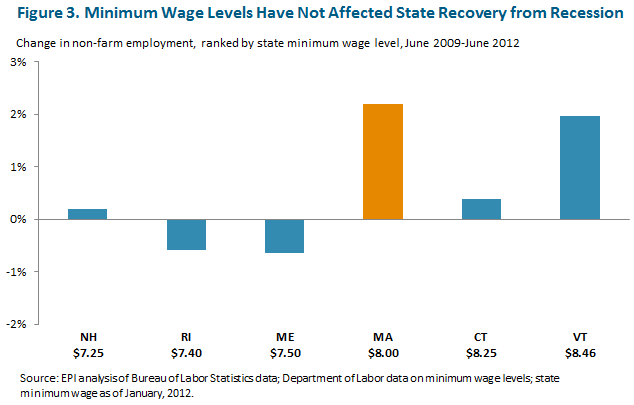

As also shown here, states with higher minimum requirements have actually faired better than those with lower wages in the 2009-2012 recovery:

2. Minimum Wage = Entry Level. The next most persistent myth is that the minimum wage is supposed to be low (even punitively so) for entry level positions, held for a short period of time, which exist mostly for the employer to evaluate the long term prospects of a new hire.

In 2012, 3.6 million American workers were paid the minimum hourly wage or less, constituting 4.7% of the hourly paid workforce. When you consider that these numbers are based on the federal minimum wage and that 18 states have legislated higher wages, a significant segment of our workforce received subsistence wages.

Admittedly, the largest segment of minimum wage workers are properly described as "entry level", but with the floor at $7.25, you need to wonder what the next step in pay would be.

On the other side of things, I also think we need to consider two truths of most employers:

1. They want to be fair to their employees.

2. They are restricted by what Americans are willing to pay.

Whenever I think of the minimum wage, I think of Main Street. I think about the small businesses that just hired on a new employee to help cover the register while the owner takes care of the backroom finances. I think about how jarring an increase of $3/hour would be to the budget of a small business. Even if you take the most simplistic response of "just raise prices", that ignores the tremendous burden wrapped up in that "easy" answer of repricing each item, running the numbers on whether that balances the books, and hoping customers are willing to pay.

For the most part, I think Washington, D.C., has a good response to this - a progressive minimum wage for large employers. But this solution has draw backs too.

Market forces have not kept up with inflation. Minimum wage is just $2 more today than it was when I first picked up my worker's permit at 14 years of age nearly two decades ago. With the obliteration of private sector unions, workers have lost the benefit of a bargaining table. How do we fix this?

That's all for today. Have a great Wednesday doing what you love!